For months, we’ve all been hearing about how the housing market is “stuck”—high mortgage rates, affordability challenges, and cautious consumers. Home Depot’s most recent analyst call echoed those themes, pointing to weak housing turnover, consumer uncertainty, and the absence of storm-driven demand as drags on their sales.

But here’s the thing: while those national headwinds are real, Greater Providence continues to show resilience. Let’s break it down.

📉 National Trends That Hit Home

- Housing Turnover Slows: Across the country, fewer people are buying and selling homes. That means less remodeling, less furnishing, and fewer big-ticket projects.

- Consumer Caution: Shoppers are deferring discretionary spending. Kitchens, bathrooms, and flooring projects are being put on hold until confidence returns.

- Storm Activity: Believe it or not, storm seasons drive demand for repairs and rebuilding. A mild season means less of that emergency-driven activity.

📊 Greater Providence Snapshot

- Inventory: Just 227 homes for sale in late October, with only 86 new listings. Supply is tight.

- Speed: Homes go pending in about 15 days. Buyers must move fast.

- Prices: Average home value sits at $419,889, up 1.1% year-over-year. Median sale price in October was $515,000, up 3% YoY.

- Neighborhoods:

- College Hill: ~$968,317

- Downtown: ~$548,504

- Federal Hill: ~$430,068

- Valley/Smith Hill: ~$369K–$373K

🧭 What It Means for Buyers & Sellers

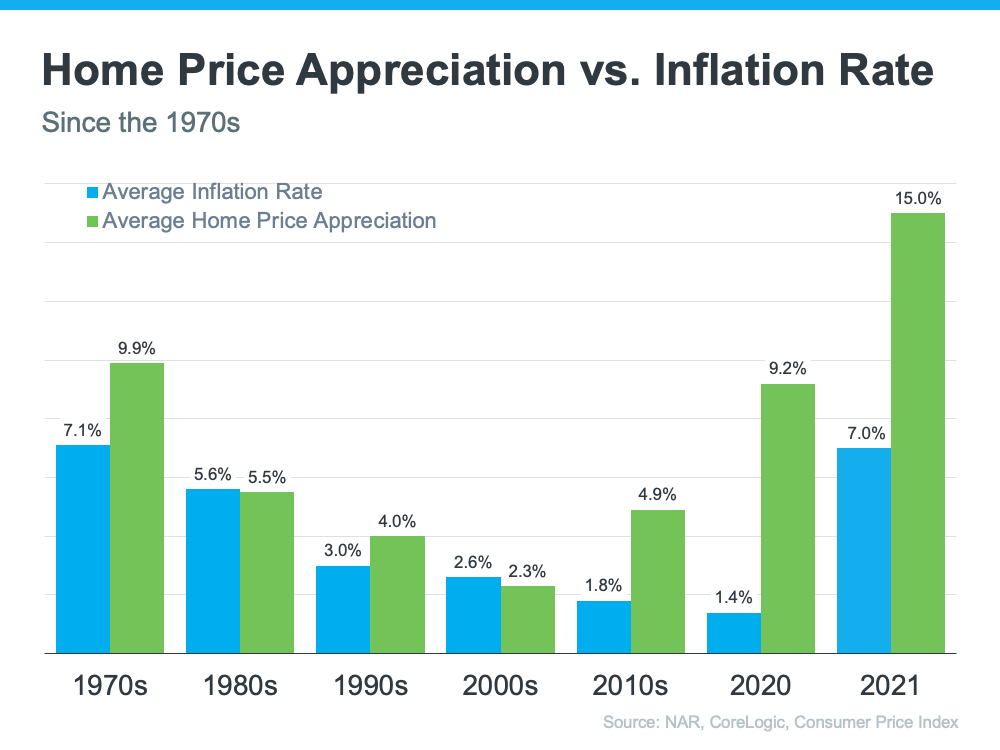

- For Buyers: Yes, rates are high. But inventory is scarce, and homes are still moving quickly. Waiting for the “perfect” rate could mean missing out on the right property.

- For Sellers: Demand remains strong enough to keep values stable. Homes are selling near list price, often with multiple offers. If you’re considering listing, the market is still in your favor.

- For Investors: Providence remains attractive as a safe-haven asset. Tight supply and steady demand make real estate here a hedge against broader economic uncertainty.

🔮 Outlook

Nationally, the housing market is in a holding pattern—waiting for lower rates or stronger consumer confidence. Locally, Providence’s severe inventory shortage keeps values resilient. Expect modest price growth (~3.5% in 2026), fast-moving listings, and continued competition in desirable neighborhoods.

Bottom Line: The same forces slowing Home Depot’s sales—cautious consumers, weak turnover, affordability pressures—are shaping our housing market. But in Greater Providence, scarcity keeps the market competitive. If you’re thinking about buying, selling, or investing, the window of opportunity is still open.

Above image and some data generated by AI.