Understanding the Risks and Rewards

By Joe Luca, REALTOR®

RE/MAX Preferred

Host of The Joe Luca Real Estate Show

Real estate has long been considered one of the most reliable ways to build long-term wealth. Traditionally, however, investing in property required significant capital, financing approval, and the ability to manage a physical asset.

Over the past decade, a new model has emerged that promises to make real estate investing more accessible: real estate crowdfunding.

Many investors have heard about it, but relatively few fully understand how it works — or the potential risks involved.

If you’re exploring ways to invest in real estate, it’s important to understand both sides of the equation.

What Is Real Estate Crowdfunding?

Real estate crowdfunding allows multiple investors to pool their money together through an online platform to fund a real estate project.

Instead of purchasing an entire property, investors buy fractional shares of a deal.

These investments may fund projects such as:

- Apartment building acquisitions

- Commercial developments

- Industrial warehouses

- Fix-and-flip projects

- Large residential developments

In theory, crowdfunding allows investors to participate in deals that would otherwise be out of reach.

Some platforms advertise minimum investments as low as $500 to $5,000.

For many people, that accessibility is appealing.

But accessibility does not eliminate risk.

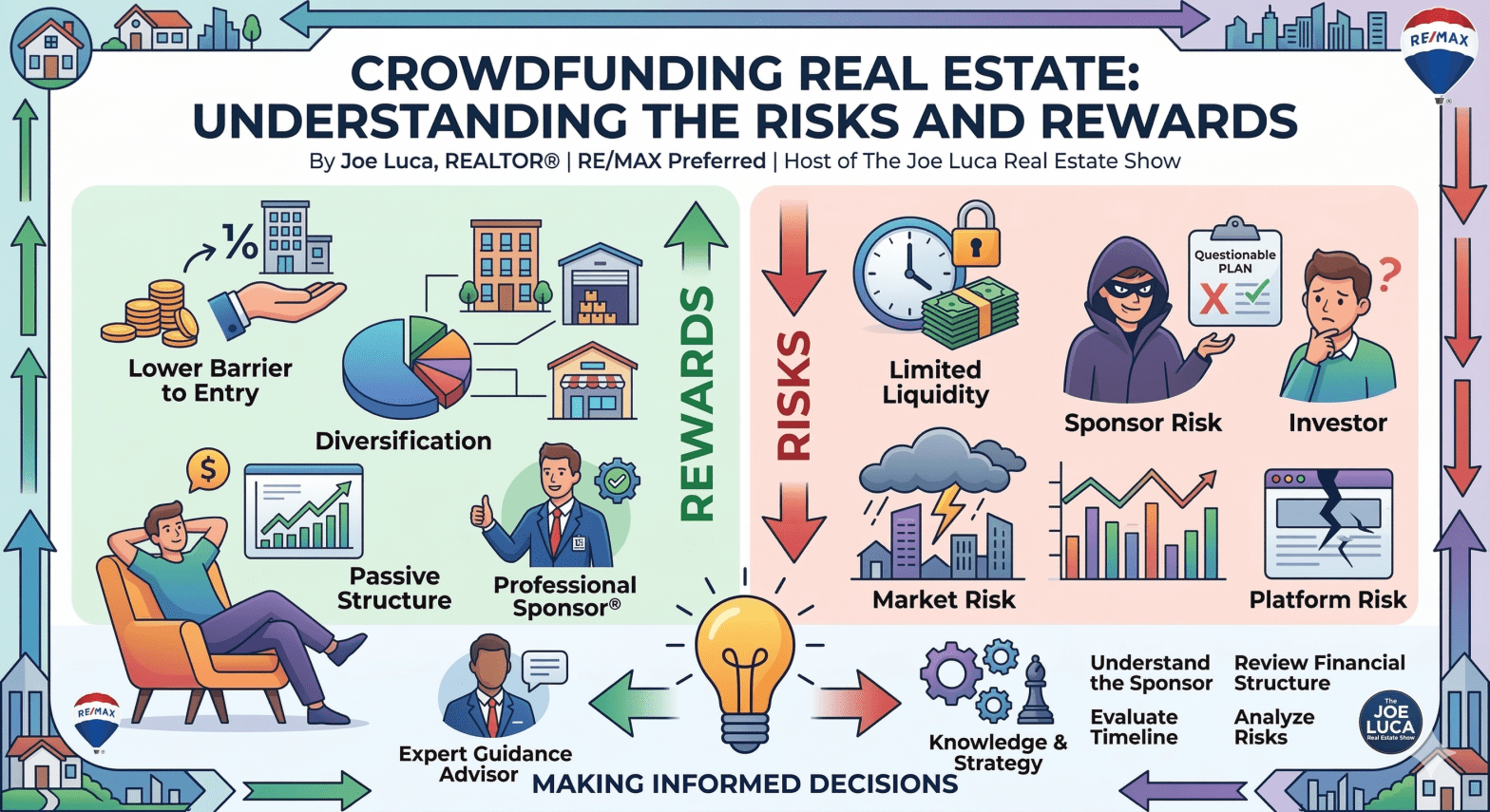

The Potential Advantages

Crowdfunding platforms often highlight several benefits.

Lower Barrier to Entry

Traditionally, purchasing investment property required substantial down payments, financing, and closing costs.

Crowdfunding allows smaller investments to participate in large deals.

Diversification

Instead of owning one property, an investor could spread funds across multiple projects in different markets.

Passive Structure

In most crowdfunding deals, the investor does not manage the property. A professional sponsor or operator runs the project.

This structure appeals to investors who want exposure to real estate without the responsibilities of being a landlord.

The Risks Investors Must Understand

While the advantages are often marketed heavily, the risks deserve equal attention.

Limited Liquidity

Many crowdfunding investments lock your capital up for 3–7 years or longer.

Unlike stocks, you generally cannot sell your shares quickly if you need access to your money.

Sponsor Risk

The success of the project depends heavily on the experience and integrity of the deal sponsor.

If the sponsor mismanages the project, investors may lose part or all of their investment.

Platform Risk

The crowdfunding platform itself may face financial challenges.

If the platform fails, communication and asset management can become complicated.

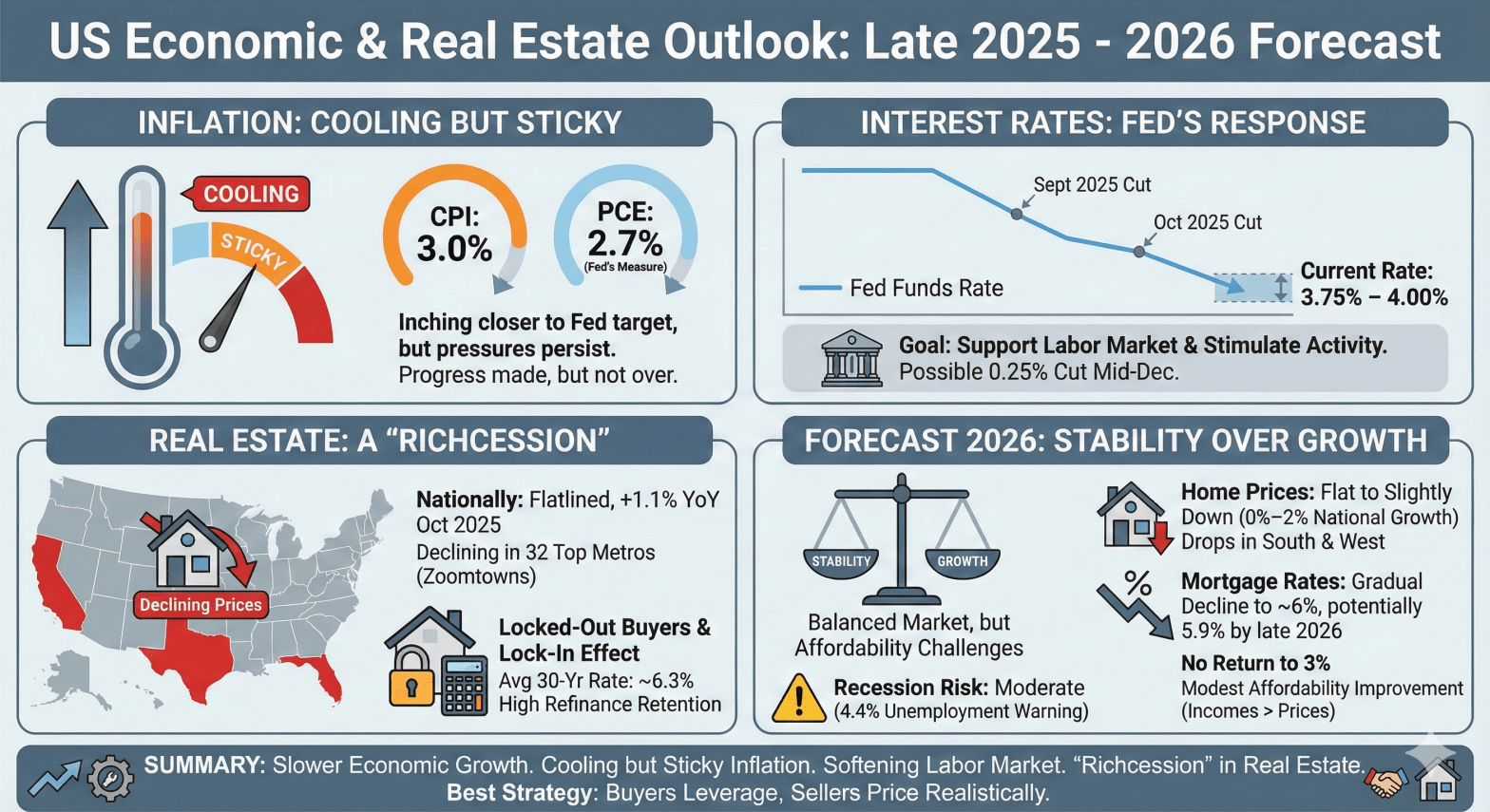

Market Risk

Just like any real estate investment, these projects are affected by interest rates, economic conditions, and local supply and demand.

Direct Ownership vs. Crowdfunding

Many investors ask whether crowdfunding is better than owning real estate directly.

The truth is that they are very different strategies.

Direct ownership provides:

- Control over the asset

- Tax advantages

- The ability to add value through improvements

- Financing leverage

- Long-term equity growth

Crowdfunding, on the other hand, is typically a passive financial investment, more similar to owning shares in a private fund.

Neither approach is inherently better.

The right strategy depends on an investor’s goals, risk tolerance, and level of involvement.

Why Guidance Matters

One of the biggest mistakes investors make is assuming that all real estate investments work the same way.

They do not.

The structure of the deal, the financing behind it, the operator’s experience, and the local market conditions all matter.

That is why working with experienced professionals who understand real estate investment strategy can make a significant difference.

Whether someone is exploring crowdfunding, rental properties, multifamily investments, or commercial real estate, the goal should always be the same:

Make informed decisions that create the best possible outcome for your future.

Final Thoughts

Real estate crowdfunding can be an interesting addition to an investment portfolio, but it should never be approached casually.

Before investing, take the time to understand:

- The sponsor behind the deal

- The financial structure

- The expected timeline

- The risks involved

Real estate remains one of the most powerful wealth-building tools available, but like any investment, knowledge and strategy matter.

About the Author

Joe Luca is a Rhode Island REALTOR® with RE/MAX Preferred and the host of The Joe Luca Real Estate Show. His mission is to help buyers, sellers, and investors make informed real estate decisions that lead to strong long-term outcomes.

You can find more educational resources at:

http://www.CupOfJoeLuca.com