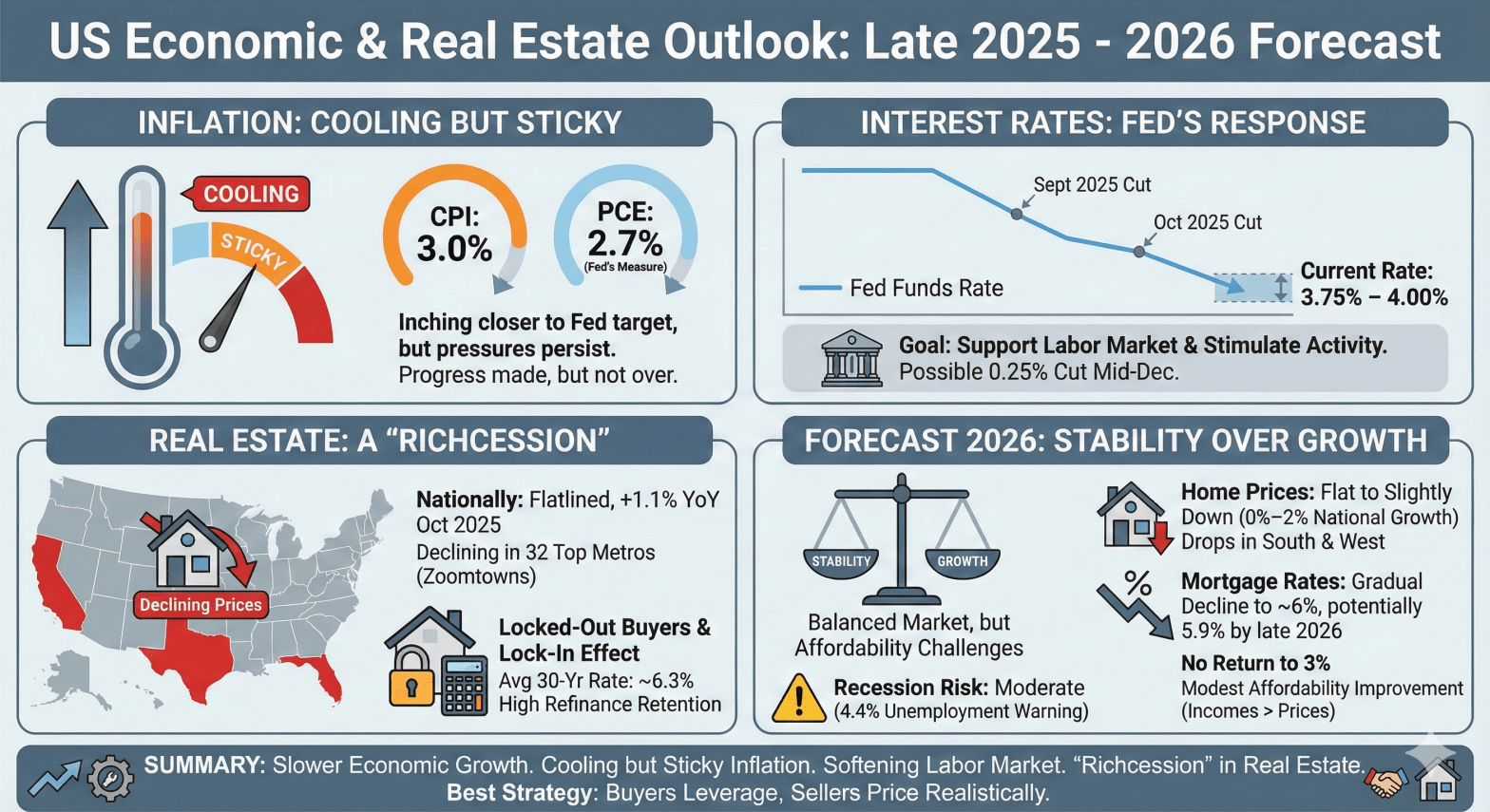

Inflation has been a hot topic throughout 2025, and recent data indicates that it is inching closer to the Federal Reserve’s target. As of September 2025, the Consumer Price Index (CPI) sits at 3.0%, showing signs of cooling. However, inflation remains sticky, with the Personal Consumption Expenditures (PCE) index, the Fed’s preferred measure, hovering around 2.7%. While these figures suggest progress, the persistence of inflationary pressures means that the Fed’s job is far from over.

Interest Rates: Fed’s Response to a Softening Labor Market

In response to the softening labor market, the Federal Reserve has shifted its stance on interest rates. After cutting rates in September and October 2025, the current rate stands at 3.75%–4.00%. The Fed’s goal is to support the labor market and stimulate economic activity. Another 0.25% cut is possible in mid-December, though not guaranteed. This proactive approach by the Fed aims to mitigate the impact of rising unemployment and ensure economic stability.

Home Prices and Sales: A “Richcession” in Real Estate

The real estate market is experiencing its own set of challenges. Nationally, home price growth has nearly flatlined, slowing to just 1.1% year-over-year in October 2025. We are witnessing a “richcession” in real estate, with prices actively declining in 32 of the top 100 metros, particularly in “Zoomtowns” and pandemic boom markets like Florida, Texas, and California. Sales activity remains sluggish, as high costs have locked out first-time buyers, and the “lock-in effect” keeps some inventory off the market. Current 30-year fixed mortgage rates are averaging in the high-6% range, approximately 6.3%. Despite these high rates, refinance retention has hit a multi-year high as homeowners desperately seek to lower monthly payments where possible.

Forecast: What to Expect in 2026

Looking ahead to 2026, the consensus is “Stability, over Growth.” We are moving toward a balanced market, but affordability will remain a primary challenge. The recession risk is moderate, with the “soft landing” being the baseline scenario. However, the rising unemployment rate (4.4%) is a warning sign. If job losses accelerate, a mild recession could occur. Home prices are expected to remain flat to slightly down, with national prices growing 0%–2%. However, price drops are anticipated in the South and West as inventory floods those markets. Mortgage rates are expected to gradually decline, averaging near 6% and potentially dipping to 5.9% by late 2026. A return to 3% rates is unlikely. With incomes rising faster than home prices, affordability will improve slightly for the first time in years.

Best Strategy for Buyers and Sellers

For buyers, now is the time to leverage your negotiating power, which is stronger than at any point since 2019. For sellers, pricing realistically is critical, as bidding wars are largely a thing of the past. Navigating the real estate market in 2026 will require a strategic approach, but with the right information and preparation, both buyers and sellers can achieve their goals.

In conclusion, while the economy is growing, it is doing so at a slower pace. Inflation is cooling but remains sticky, and the labor market is softening. The Federal Reserve is taking steps to support the economy, and the real estate market is experiencing a “richcession.” As we look ahead to 2026, stability is the key theme, with moderate recession risk and gradual improvements in affordability. By staying informed and strategic, you can navigate these economic changes successfully.

The above image was created with ai based on data in this post.