— It’s a Wealth Asset

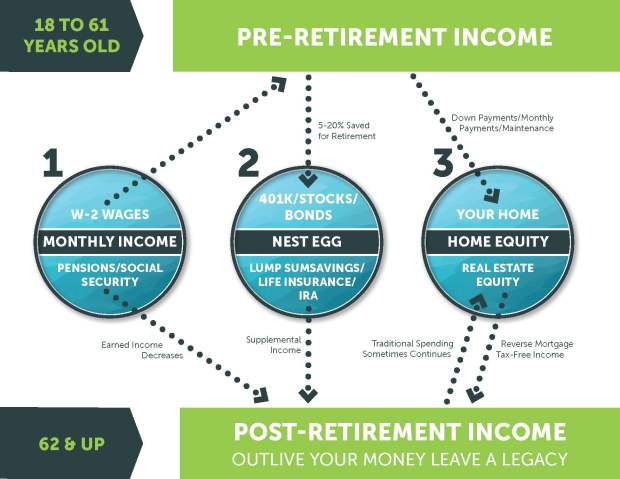

If you’re a homeowner—especially if you’ve owned your home for many years—there’s something important you should understand:

Your home isn’t just where you live.

It’s likely one of the largest financial assets you will ever own.

Yet for many homeowners, real estate decisions are made emotionally or reactively, without fully considering how those choices affect long-term wealth, taxes, and legacy planning. As we move closer to potential tax law changes in 2026, these decisions matter more than ever.

Why Home Equity Deserves Strategic Planning

For most families, home equity quietly grows in the background. Over time, appreciation, mortgage paydown, and market conditions can create substantial wealth—often exceeding retirement accounts or other investments.

But that equity doesn’t automatically protect itself.

Real estate decisions can trigger:

- Capital gains tax exposure

- Unintended estate complications

- Liquidity issues for heirs

- Missed planning opportunities

Selling too early, holding too long, or failing to coordinate real estate decisions with broader financial and estate plans can result in costly outcomes that were entirely avoidable.

Capital Gains, Timing, and the Road Ahead

Many homeowners are surprised to learn that selling a primary residence can have tax consequences—especially for those who’ve owned their homes for decades or experienced significant appreciation.

While today’s rules offer certain exclusions, tax laws are not static. Discussions around changes after 2025 have already prompted questions about:

- Whether current capital gains exclusions will remain

- How inherited property may be treated in the future

- When it makes sense to sell, hold, or restructure ownership

These aren’t questions to answer in a rush—or alone.

Estate Planning and Where Your Equity Goes

Another often-overlooked issue is what happens to your home when you’re no longer here.

Without thoughtful planning, heirs can face:

- Confusion around selling or retaining the property

- Unexpected tax exposure

- Family conflict or delays

- Loss of value due to poor timing or forced decisions

Your home is part of your legacy. Like any significant asset, it deserves clarity, coordination, and foresight.

Why Real Estate Guidance Matters in Wealth Protection

Real estate is unique. It’s emotional, local, highly regulated, and deeply connected to tax and estate planning—yet it’s often treated as an afterthought.

The truth is:

Real estate decisions should support your overall wealth strategy—not undermine it.

That’s why informed homeowners take a proactive approach, asking better questions and assembling the right professionals before decisions are forced by life events, health changes, or market shifts.

A Practical, Education-First Approach

This blog is the first in a series focused on wealth protection for homeowners. The goal is simple:

- To explain complex topics in clear, practical terms

- To help homeowners understand how real estate fits into long-term planning

- To reduce uncertainty and avoid surprises

This is not about fear or speculation. It’s about clarity, predictability, and informed decision-making.

Final Thoughts

Your home represents years—sometimes decades—of hard work. Protecting that value requires more than market knowledge; it requires planning, timing, and coordination.

I’m Joe Luca The Best Realtor, and I work with homeowners who want thoughtful guidance around major real estate decisions—especially when those decisions intersect with taxes, estate planning, and long-term wealth preservation.

If these topics matter to you or your family, I invite you to follow along as we continue this conversation.

Because informed decisions today – protect your wealth tomorrow.