Pricing your home correctly is one of the most important decisions you’ll make when preparing to sell. It affects everything — how many buyers see your home, how quickly it sells, and ultimately, how much money you walk away with.

As a REALTOR® who has helped Rhode Island homeowners since 2006, I’ve seen one truth play out over and over again: the right price attracts buyers, creates competition, and leads to the best possible outcome for you. The wrong price does the opposite.

If you’re thinking about selling, here’s what you need to know about pricing your home strategically and confidently.

Why Pricing Your Home Correctly Matters

Many sellers assume they should “start high and negotiate down.” Unfortunately, that strategy almost always backfires.

When a home is overpriced:

- Fewer buyers see it

- Serious buyers skip it

- It sits on the market longer

- Price reductions become inevitable

- Buyers start wondering what’s wrong with it

On the flip side, a well‑priced home:

- Attracts more showings

- Generates stronger offers

- Creates urgency and competition

- Sells faster

- Often sells for more than expected

Pricing isn’t guesswork — it’s a strategy.

How I Determine the Right Price for Your Home

A strong pricing strategy blends data, experience, and market psychology. Here’s the process I use with every client:

1. Comparative Market Analysis (CMA)

I analyze recent sales of similar homes in your area — size, condition, features, location, and upgrades. This gives us a realistic baseline of what buyers are willing to pay right now.

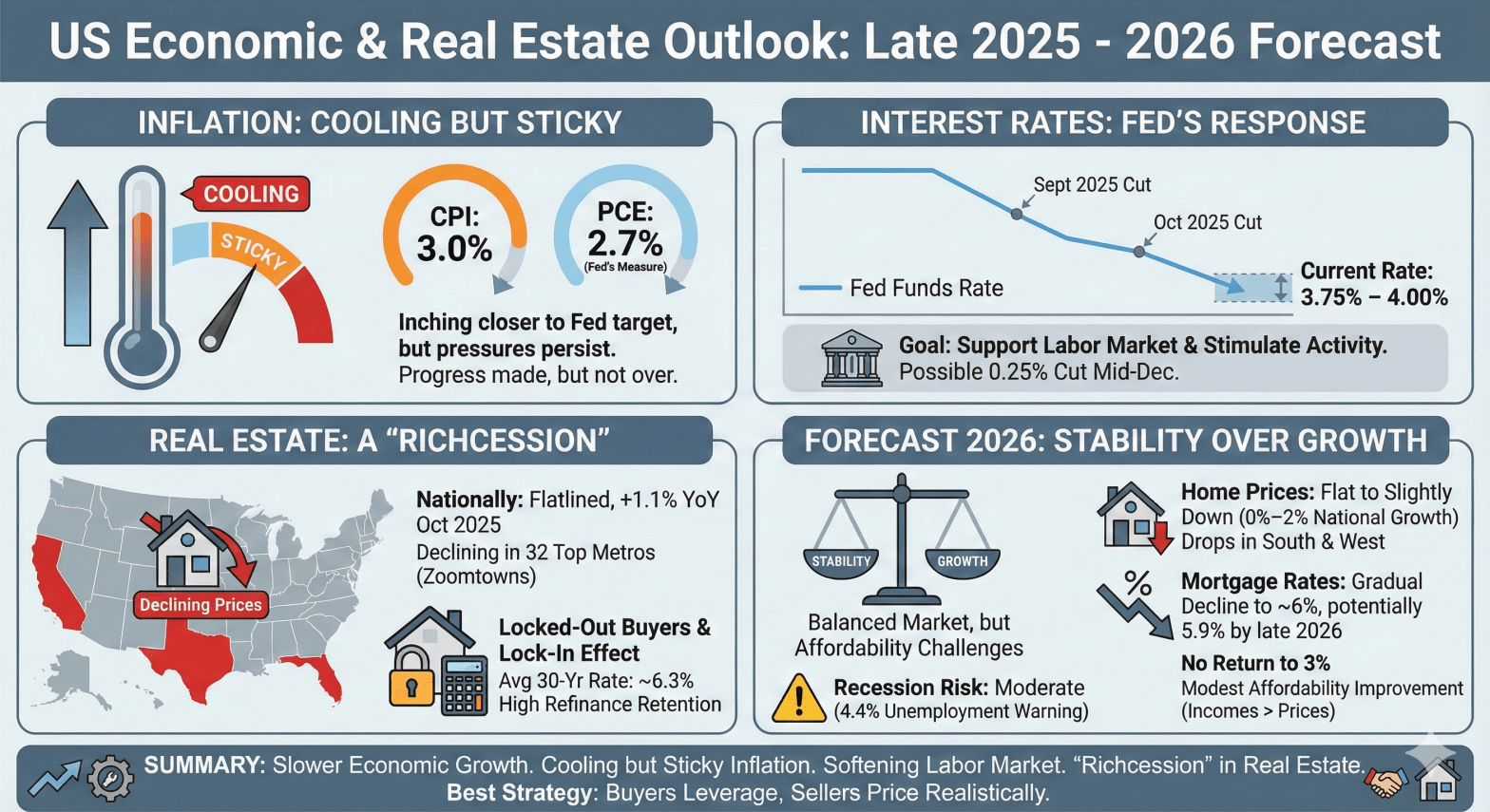

2. Current Market Conditions

The real estate market changes constantly. Inventory levels, interest rates, and buyer demand all influence your home’s value. A smart pricing strategy adapts to the market, not the other way around.

3. Your Home’s Unique Value

Not all homes are created equal. Upgrades, layout, curb appeal, neighborhood desirability, and overall condition can push your value higher than the comps suggest.

4. Pricing Psychology

Buyers search in price brackets. Listing at the right number increases your visibility on real estate platforms and AI‑powered search tools. Sometimes a small adjustment — like $499,900 instead of $505,000 — can dramatically expand your buyer pool.

Common Pricing Mistakes to Avoid

I’ve seen homeowners unintentionally sabotage their sale by making these avoidable mistakes:

- Pricing based on emotion instead of data

- Assuming upgrades automatically equal higher value

- Ignoring market shifts

- Comparing their home to properties that aren’t truly comparable

- Starting high “just to see what happens”

Avoiding these pitfalls is key to selling your home quickly and profitably.

My Client‑First Approach

My priority is simple: create the best possible outcome for you.

That means honest guidance, transparent communication, and a pricing strategy built around your goals — whether that’s maximizing your profit, selling quickly, or preparing for your next move.

When you work with me, you’re not just hiring a listing agent. You’re partnering with a seasoned strategist who understands the Rhode Island market, buyer behavior, and the systems required to deliver results.

Thinking About Selling? Let’s Talk.

If you’re curious about what your home is worth in today’s market, I’d be happy to prepare a free, no‑obligation home valuation.

You’ll get:

- A detailed market analysis

- A recommended pricing strategy

- Insights on how to position your home for maximum impact

Reach out anytime — I’m here to help you make smart, confident decisions.